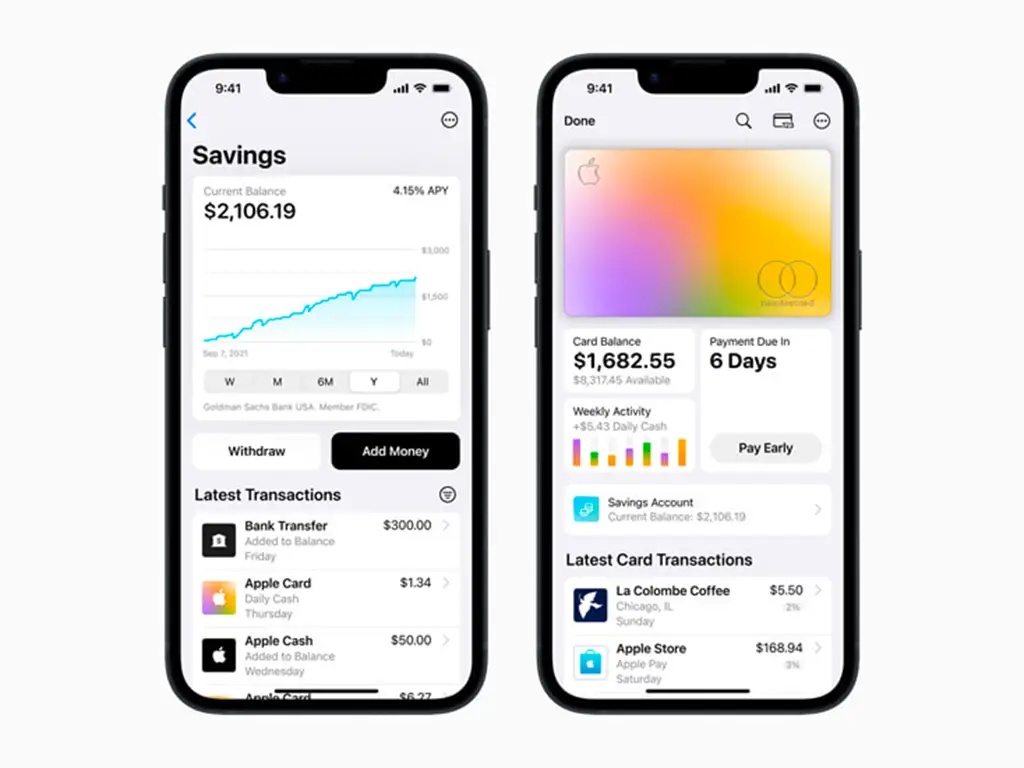

Apple has launched its Card-linked high-yield savings account that comes with a 4.15 percent APY.

First announced in October of last year, the Apple Card savings account is now available to Apple Card users across the US.

More Apple News | Apple Patent Shows The iPod Could Be Making A Comeback

Starting today, Apple Card users can choose to do more with their Daily Case rewards with a Savings account from Goldman Sachs, which offers a high-yield APY of 4.15 percent. Apple says there are no fees, no minimum deposits, and no minimum balance requirements. Moreover, users can easily set up and manage their Savings account directly from Apple Card in Wallet

“Savings helps our users get even more value out of their favorite Apple Card benefit — Daily Cash — while providing them with an easy way to save money every day,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet. “Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place.”

What you need to open and maintain an account

- Be an owner or co-owner of an active Apple Card account and add Apple Card to your iPhone.

- Be at least 18 years or older.

- Have a social security number or individual taxpayer identification number.

- Be a U.S. resident with a valid, physical U.S. address.7

- Set up two-factor authentication for your Apple ID and update to the latest version of iOS (16.4.1)

How to set up Savings

- On your iPhone, open the Wallet app and tap Apple Card.

- Tap the More button

, then tap Daily Cash.

, then tap Daily Cash. - Tap Set Up next to Savings, then follow the onscreen instructions.

Once set up, all your future Daily Cash earned will be automatically deposited into the account, but you will always have the option to change this setting at any time and choose to pay your rewards to your bank account or use them to pay for purchases using your wallet. To build on your savings, you can also deposit additional funds through a link bank account or your existing Apple Cash balance. There is no limit to how much money you can add to your savings account. You can also withdraw funds at any time by transferring them to a linked bank account or to your Apple Cash card, with no fees.

More Apple News | Apple Could Soon Allow Third-Party App Stores On The iPhone

You will also have access to an easy-to-use Savings dashboard in Wallet, where you can conveniently track your account balance and interest earned over time.