Only days after Facebook’s stock took a record $100 billion tumble, Twitter’s shares are also down 20% after the company’s quarterly results announcement.

Times are tough for social media giants. Last week, Facebook lost over $100 billion in market capitalization after falling short of Wall Street’s expectations. Now, it’s Twitter’s turn. The company’s shares went down 20% after Twitter announced a drop of one million monthly users in Q2.

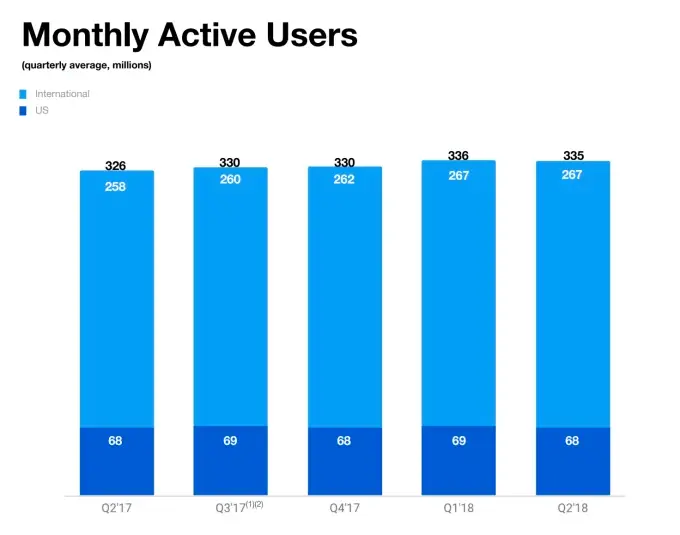

Twitter now counts 335 million users overall, with 68 million users in the US, down by 1 million since the previous quarter. It is this struggle to grow in the US that is getting shareholders worried about the company’s capabilities to grow and retain users overall.

Of course, Twitter has made no secret of its on-going “clean up” to make conversations more meaningful on its platform. That means deleting millions of fake, or locked accounts. But according to the company itself, these don’t have as big an impact on MAUs:

“When we suspend accounts, many of the removed accounts have already been excluded from MAU or DAU, either because the accounts were already inactive for more than one month at the time of suspension, or because they were caught at signup and were never included in MAU or DAU.”

That being said, Twitter might feel it was a little bit unfair for Wall Street to “punish” it. The company had a record quarter of profit. GAAP net income came in at $100 million, with revenue up by 24% year-on-year.

Obviously, this was not enough…

[box]Read next: The Big Clean Up Continues: Twitter Suspended 143,000 Apps Last Quarter[/box]